The American Recovery and Reinvestment Act has created energy tax credits, which are different than tax deductions in that they apply directly to reduce taxes. The broad categories for these credits are: Building Envelope, HVAC systems and Renewable Energy.

“Building Envelope” refers to items such as roofing and insulation, windows and doors. The credit for these items is 30% of the cost of the product, excluding labor, with a maximum of $1,500 for all improvements combined.

HVAC Systems cover wood stoves and water heaters along with traditional HVAC systems. You can receive a 30% credit of the total cost of the materials and labor under this umbrella with a maximum of $1,500.

Under the “Renewable Energy” umbrella, there are many avenues where you can take advantage of the substantial energy credits in this arena. This covers items such as photovoltaics (solar electric panels), wind energy, fuel cells, solar water heaters and geothermal heat pumps. These credits act differently than the two stated above as you receive a 30% tax credit of the total cost of the items, which includes the cost of the product and labor, with no maximum; any unused credit may carry over to future tax years!

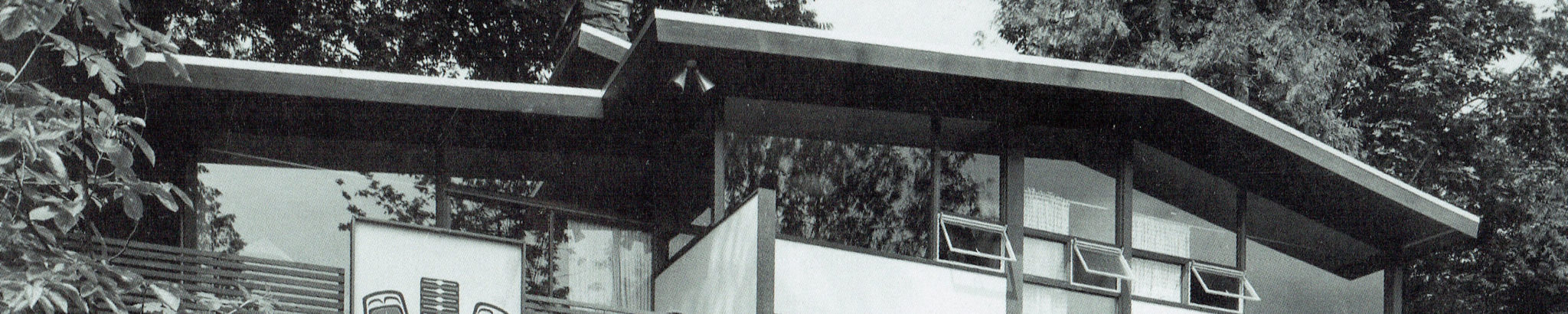

The architecture of our new home project on Camano Island (www.ctabuilds.com/camano.html) utilizes large South facing glazing to take advantage of solar gain, utilizes a geothermal heat pump and is additionally prepped for future photovoltaic arrays on a specially designed flat roof section.

For more information on these energy tax credits, please visit: http://www.energystar.gov/index.cfm?c=tax_credits.tx_index

Categories:

Categories:

Tags:

Tags: